AI process optimization goes beyond traditional rule-based systems. It brings intelligence, adaptability, and foresight to business operations. HR workflow automation streamlines onboarding, benefits administration, and policy management. Finance process automation makes payroll processing, expense management, and compliance tracking better. AI also streamlines operational efficiency through better inventory control, procurement, and vendor relationships.

The technology's effect is significant. The AI market reached $196.63 billion in 2023, mainly because it analyzes historical data quickly. On top of that, AI-assisted HR process automation helps teams process and analyze large amounts of data faster. AI projects can start small, show quick results, and get better over time as they learn from new data."

AI-powered business automation tools are changing internal processes in HR, finance, and operations departments. Organizations can streamline their operations through intelligent automation with the right implementation approach and practical applications.

Limitations of Traditional Internal Process Automation

"The first rule of any technology used in a business is that automation applied to an efficient operation will magnify the efficiency. The second is that automation applied to an inefficient operation will magnify the inefficiency." — Bill Gates, Co-founder of Microsoft, global technology leader

Traditional internal process automation doesn't meet today's business needs. Companies find it hard to work with systems that can't handle complex business environments. These inefficiencies hurt productivity and slow down growth.

- Rule-based Systems and Their Fragility in Dynamic Environments

Rule-based systems can only work within their original programming limits. They can't learn or adjust to business changes, which reduces their usefulness. Business rules change often, especially in insurance and finance sectors. Updating these systems needs extensive coding and testing, which creates delays in operations. Companies add more rules to handle complex cases. This creates conflicts between rules and slows down the system. Such rigid systems become weak spots in fast-changing business environments where adaptation helps companies survive.

- Integration Gaps Between HRIS, ERP, and ITSM Platforms

Companies often run disconnected systems in different departments. Studies show 40% of finance teams use three different tech systems for HR and finance tasks. Another 15% use four or more. This split creates information barriers and data problems that slow down decisions. As a result, 84% of IT leaders say complex integration slows their company's growth. Without proper connection between HRIS, ERP, and ITSM platforms, companies struggle to keep their data accurate and consistent.

- Manual Handoffs and Fragmented Workflows in HR and Finance

Split business processes need many handoffs between functions, jobs, and systems. Each handoff can bring errors, delays, and higher costs. Core business transactions break down and rebuild as they move toward customers. This wastes time when no value gets added. Switching between different apps drains mental energy. These small breaks reduce focus and productivity. Without good workflow automation, basic tasks like employee onboarding and offboarding take too long. These manual processes create security risks and make operations less efficient.

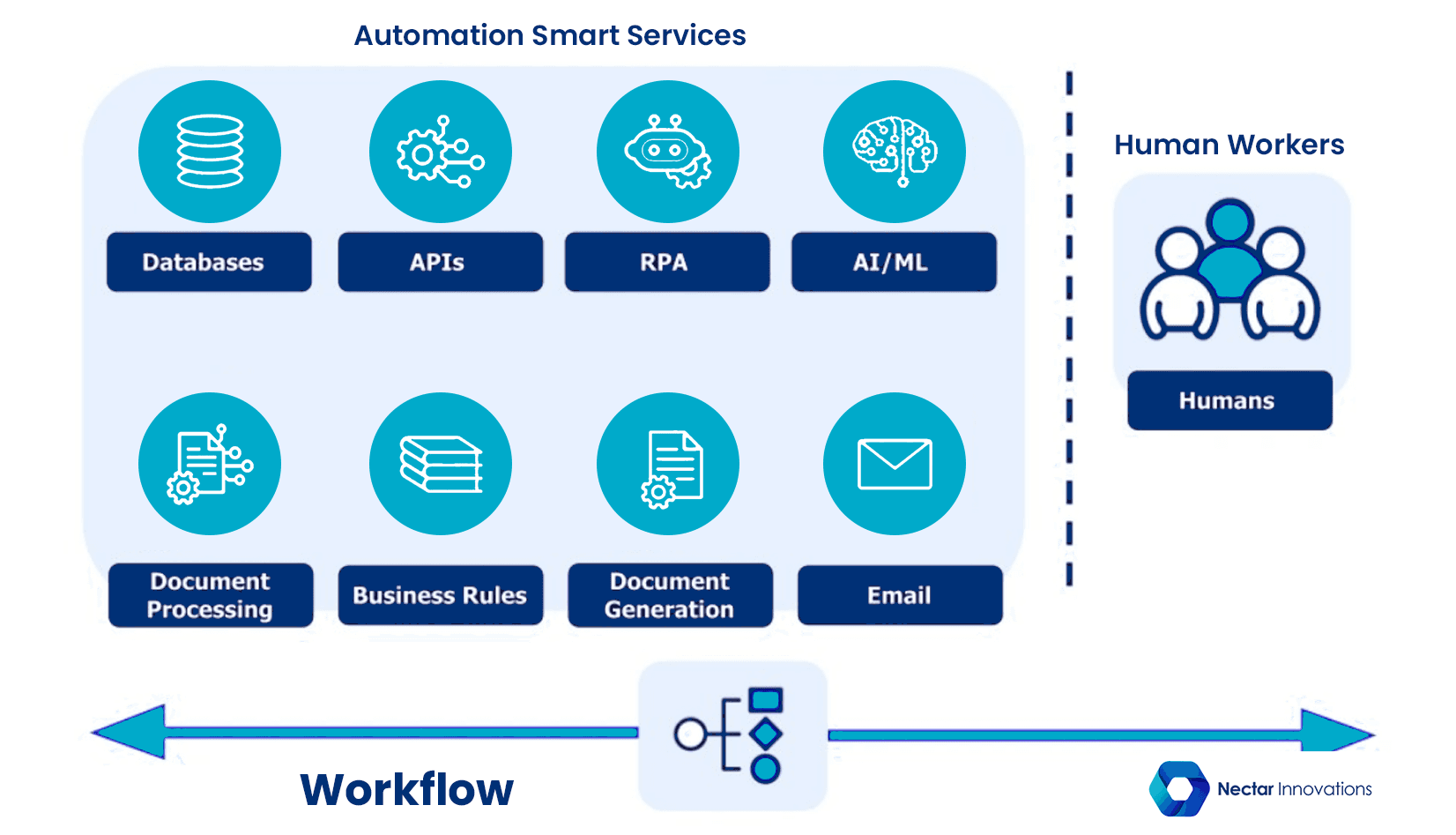

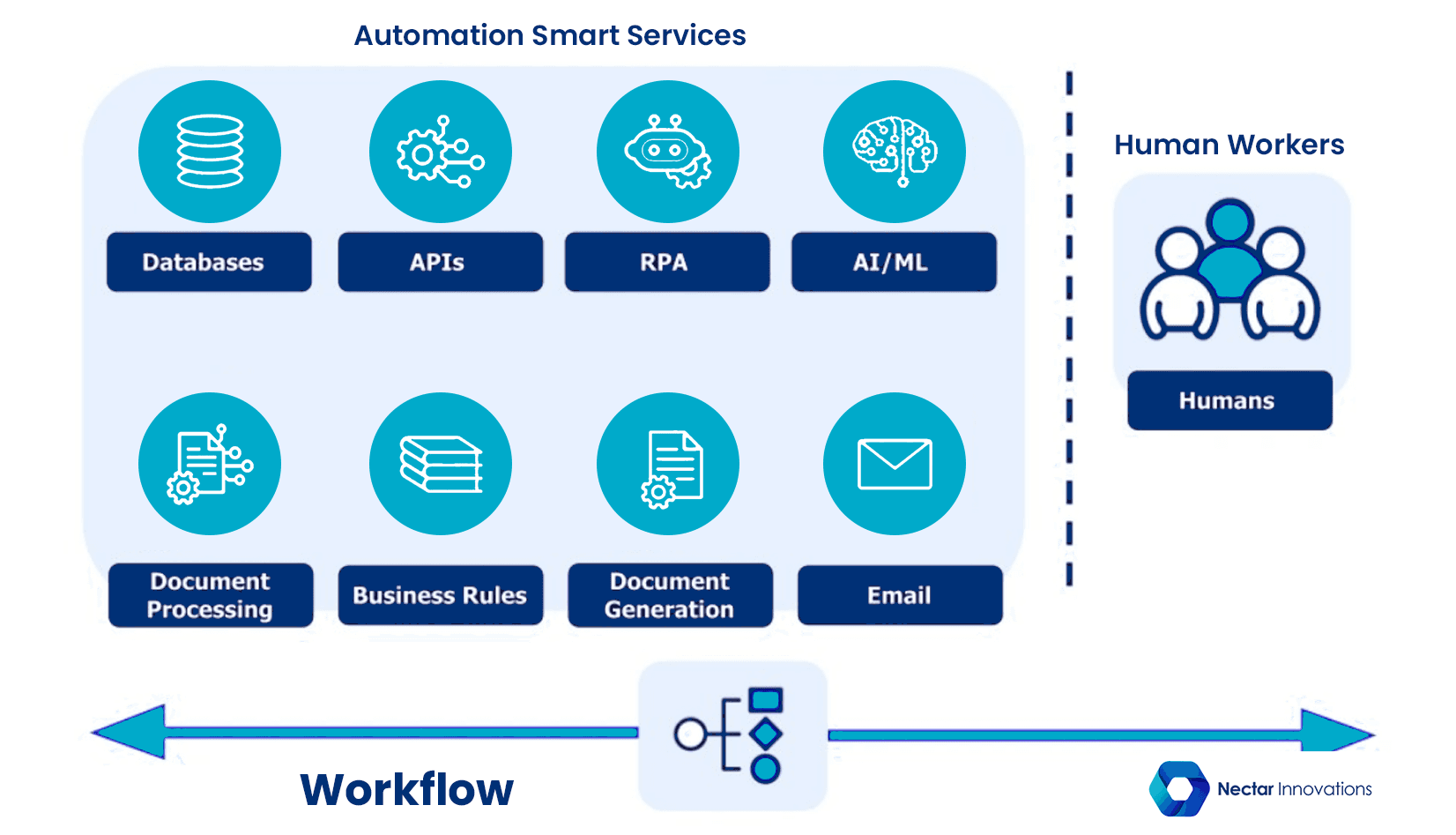

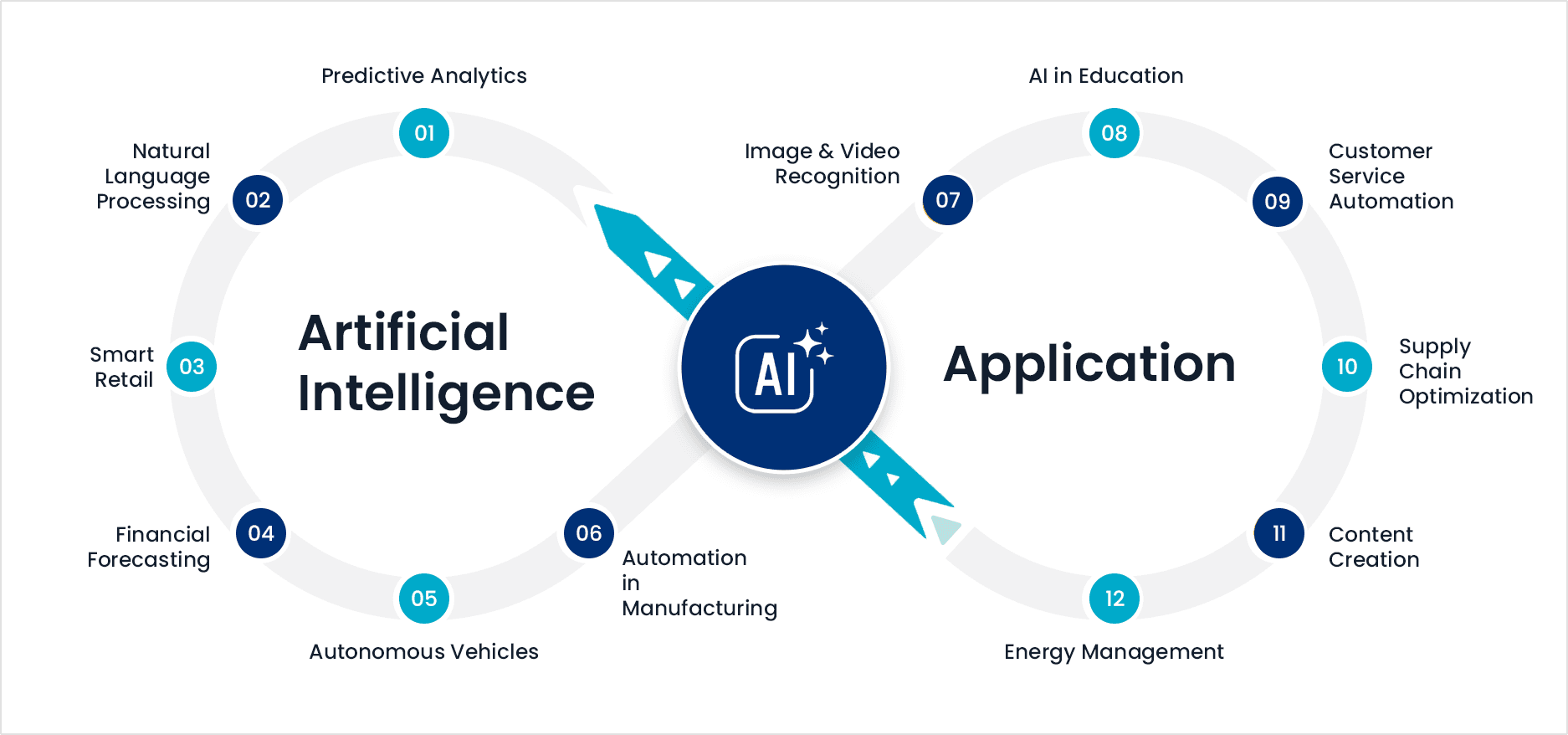

How AI Enhances Internal Process Optimization

Image Source: Appian

Modern businesses use AI technologies to surpass traditional automation's limits. AI solutions adapt to changing conditions and learn from interactions. This creates more resilient internal processes than conventional systems.

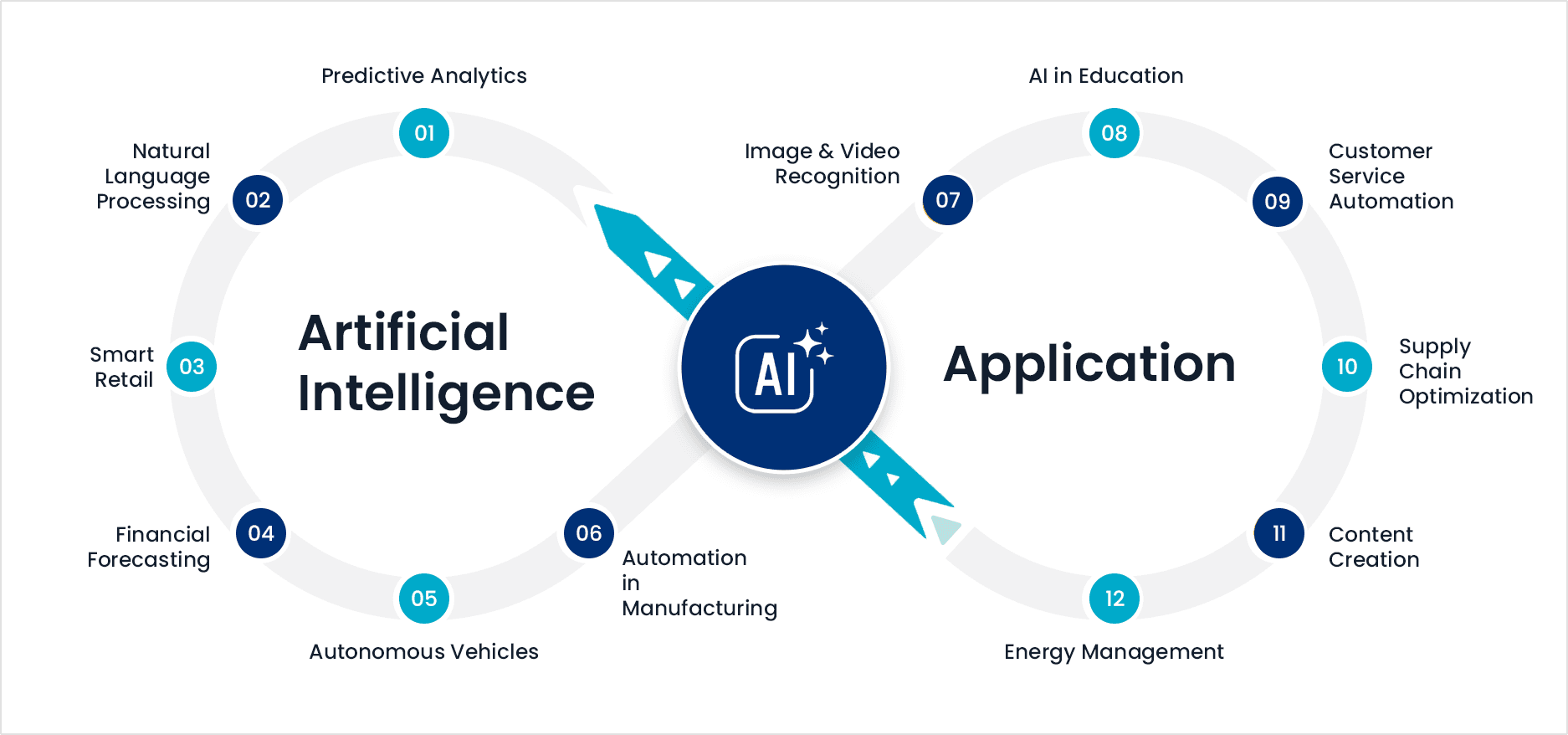

- Natural Language Processing for Employee and Vendor Queries

NLP has changed how organizations handle employee feedback and vendor communications. The technology analyzes text data from surveys, emails, and chat interactions to determine intent, theme, and sentiment. HR departments use NLP to identify emerging concerns in hundreds of thousands of employee comments. This allows managers to respond quickly to issues before they escalate. Organizations use NLP to extract valuable insights from unstructured data in contracts and communications. This simplifies relationship management and improves operational efficiency with vendors.

- Machine Learning for Predictive Decision-Making in Finance

Financial institutions use machine learning to improve decision-making through pattern recognition and predictive analytics. These algorithms analyze millions of data sets quickly and produce better outcomes without explicit programming. The applications are diverse. Algorithmic trading makes faster, emotion-free decisions. Fraud detection flags unusual transactions for security teams. Robo-advisors create individual-specific investment portfolios based on investor goals and risk tolerance. Machine learning also simplifies underwriting processes in banking and insurance. It makes quick decisions on credit scoring and saves time and money.

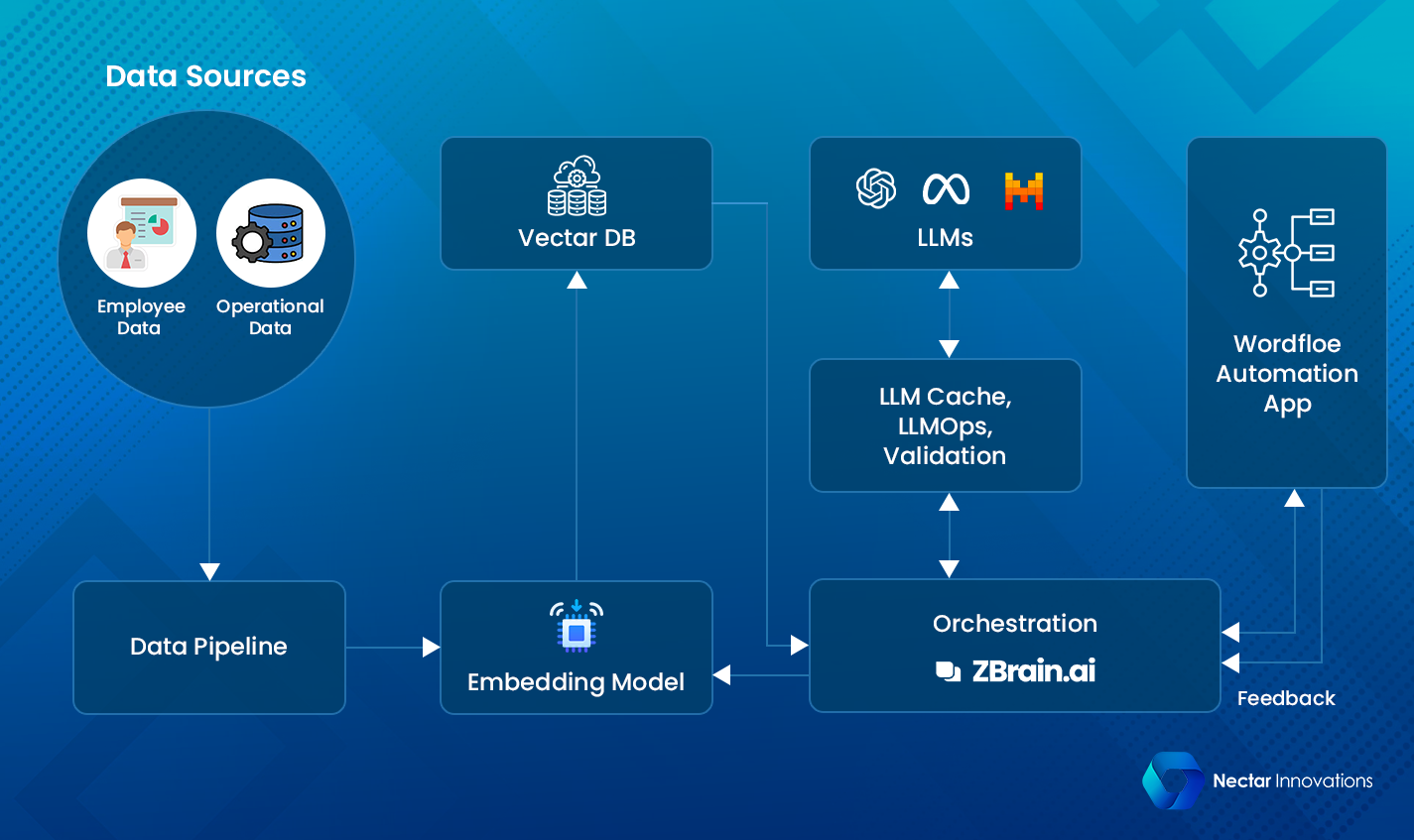

- AI Agents for End-to-End Workflow Execution

AI agents are intelligent entities that perform tasks independently across multiple systems. They combine deterministic workflows with AI-driven intelligence to handle complex enterprise scenarios with minimal human intervention. These agents excel at automating administrative duties and combine smoothly with existing business processes. Modern

AI agents use Retrieval Augmented Generation (RAG) architecture. This connects them with external knowledge sources to improve accuracy and reliability in mission-critical workflows.

- Process Mining to Identify Bottlenecks in Operations

Process mining technology helps businesses understand their actual processes through event data from systems of record. This approach shows how operations truly function and identifies bottlenecks and inefficiencies that might stay hidden otherwise. Process mining creates visual representations similar to flow charts by analyzing event logs from software platforms. These charts reveal potential problem areas, from extended processing times to compliance issues. Evidence-based visibility helps organizations create targeted optimization plans and monitor ongoing performance against key metrics.

AI-Powered Use Cases in HR, Finance, and Operations

Image Source: SlideBazaar

"Generative AI is going to allow companies to create experiences for their customers that once felt impossible. AI is no longer just a tool for niche teams. Everyone will have opportunities to use it to be more productive and efficient." — Juan Perez, Chief Information Officer, Salesforce

Companies of all sizes are using AI business automation to solve specific department challenges. These practical applications show how intelligent systems work to solve ground business problems.

- Workflow Automation in HR: Onboarding, Benefits, and Policy Acknowledgement

AI-powered onboarding boosts efficiency and employee retention by automating routine tasks. Studies show better onboarding can boost employee retention by 82%. AI systems automatically fill documents like W-4s and I-9 forms, route them for e-signatures, and check identity documents through mobile capture. AI creates tailored learning paths based on individual styles and professional goals for benefits management. The system then analyzes employee priorities to suggest specific benefits packages that match their needs.

- Finance Process Automation: Payroll, Expense Management, and Compliance

Financial process automation (FPA) revolutionizes core operations through AI and machine learning integration. Companies using expense management automation report that almost 40% of employees face cash flow problems due to delayed reimbursements. AI-driven expense systems exploit optical character recognition to extract data from receipts, fill expense reports automatically, and enforce company policies immediately. Each expense report error costs USD 52.00 to fix, which makes automation valuable.

- Operational Efficiency with AI: Inventory, Procurement, and Vendor Management

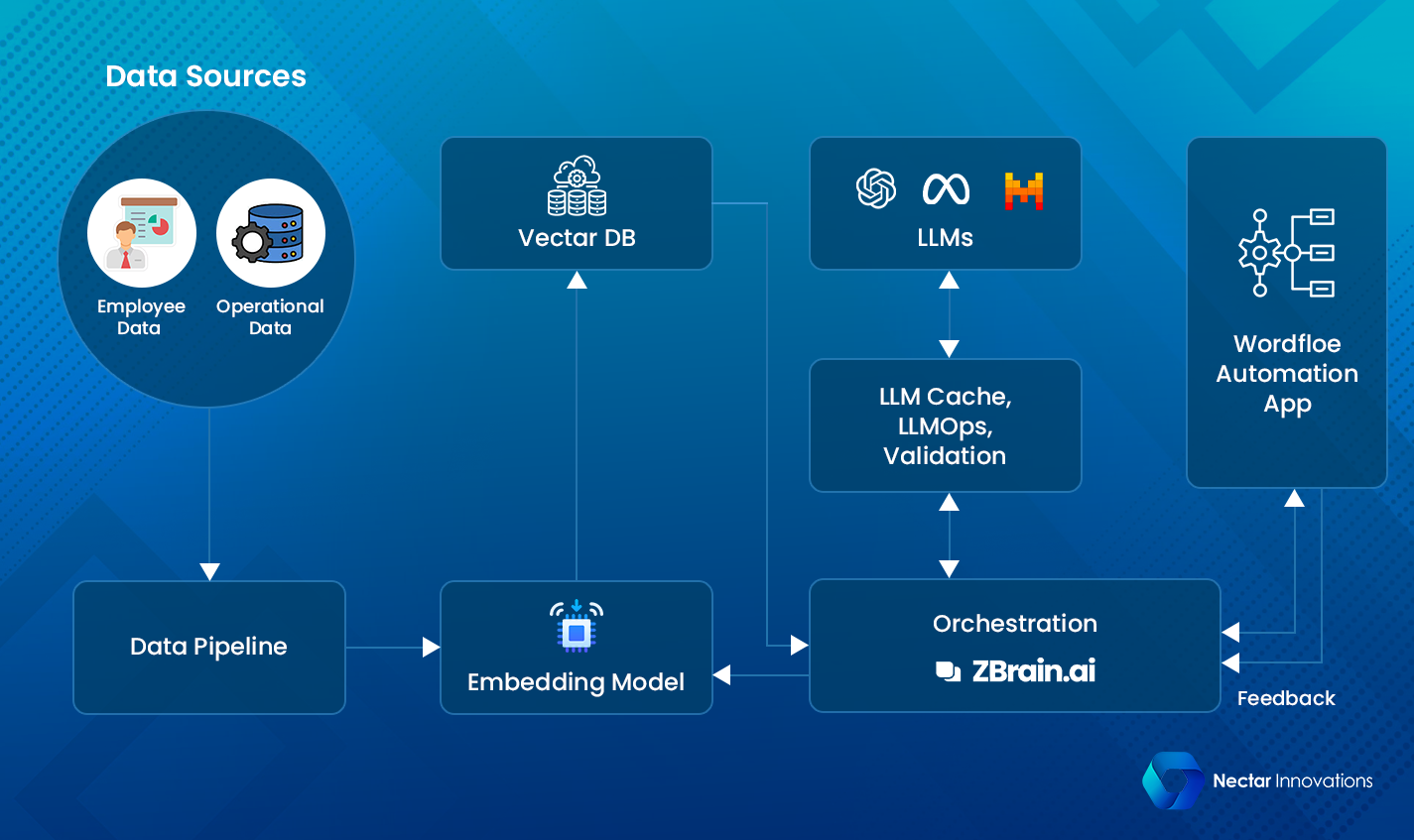

AI analytics platforms group expenditures and spot maverick buying by learning typical vendor behaviors. Predictive AI models analyze demand trends and supplier performance to suggest reorder points and preferred vendors. You can see how Nectar Innovations helps your team build smarter with AI. Schedule a call today.

- Cross-Departmental Use Case: Employee Offboarding Across HR and IT

Research shows 80-90% of employee offboarding processes can run automatically. This lets HR and IT teams reclaim time they spent on repetitive tasks. Automated offboarding systems ensure immediate SaaS deprovisioning and eliminate security risks from delayed access removal. Organizations can prevent unauthorized data access while keeping a complete audit trail for compliance needs.

Implementation Considerations and Best Practices

Image Source: LeewayHertz

AI business automation success depends on careful planning and smart strategic decisions that lead to eco-friendly outcomes. Every organization brings unique capabilities and business goals to the table. These shape how they approach implementation.

- Choosing Between RPA and Agentic AI for Internal Workflows

Organizations must review their specific needs before selecting automation technology. RPA works best with rule-based, repetitive processes that have structured data and stable workflows. Agentic AI shines when tasks need judgment calls, process unstructured data, or require adaptive workflows. Many organizations achieve the best results through hybrid approaches. They use RPA to handle predictable backend processes and deploy agentic AI for complex decision-making and customer interactions.

- Data Governance and Role-Based Access Control

AI systems handle sensitive information, so resilient data governance frameworks matter greatly. Role-based access control (RBAC) matches permissions to job roles instead of individual users. This ensures employees can only access the data they need. Nectar Innovations can help your team build smarter with AI - schedule a call today. Strong security protocols should protect data storage. Teams need to audit access permissions regularly to stay compliant with changing regulations.

- Monitoring, Retraining, and Feedback Loops for AI Systems

System performance needs constant monitoring. Automated monitoring tools help track key metrics and alert teams about performance issues. Regular model retraining helps prevent degradation from concept drift - the gap between training data and ground data. Teams should create feedback loops to share both successful experiments and failures. This helps improve future iterations continuously.

Conclusion

AI-assisted process optimization has revolutionized HR, finance, and operations departments. Organizations worldwide have realized that traditional rule-based systems cannot adapt to today's ever-changing business environments. Manual handoffs in these older systems lead to errors, fragmentation, and inefficiencies that hurt productivity.

AI solutions are changing this landscape through natural language processing, machine learning, intelligent agents, and process mining capabilities. Companies using these technologies gain clear advantages in many areas. They can efficiently onboard employees, automate expense management, and control inventory better. The numbers tell a compelling story: AI-powered onboarding helps companies retain 82% more employees, while automated expense reports save about $52 each.

Smart planning paves the way to successful AI-powered business automation. Leaders must review whether RPA or agentic AI matches their workflow needs. They need resilient data governance frameworks with role-based access controls. Continuous monitoring systems help maintain peak performance, and feedback loops aid constant improvement.

AI business automation will grow more sophisticated as machine learning models and integration capabilities advance. Companies that apply these technologies now will boost their operational efficiency, cut costs, and improve their employees' work life. Tomorrow's workplace will blend human expertise with AI-driven process optimization. Teams will focus on adding value while smart systems handle routine tasks precisely and adaptively.

Key Takeaways

Organizations are revolutionizing their internal operations by moving beyond traditional rule-based systems to embrace AI-powered automation that adapts, learns, and optimizes processes across departments.

- AI transforms repetitive work into strategic advantage: HR teams can reclaim a full workday weekly by automating routine tasks, while effective AI-powered onboarding improves employee retention by 82%.

- Smart integration eliminates costly fragmentation: AI bridges gaps between HRIS, ERP, and ITSM platforms, solving the problem where 40% of finance teams juggle three different systems.

- Predictive intelligence drives better decisions: Machine learning analyzes millions of data sets instantly for fraud detection, expense management, and inventory optimization, saving $52 per automated expense report.

- End-to-end automation spans departments: AI agents handle complex workflows from employee onboarding to vendor management, with 80-90% of offboarding processes now automatable.

- Strategic implementation requires hybrid approaches: Choose RPA for structured, rule-based tasks and agentic AI for complex decision-making, while establishing robust data governance and continuous monitoring systems.

The key to success lies in thoughtful planning—organizations must evaluate their specific needs, implement proper security frameworks, and create feedback loops for continuous improvement. Companies embracing AI automation today position themselves for enhanced efficiency, reduced costs, and improved employee experiences in tomorrow's intelligent workplace.